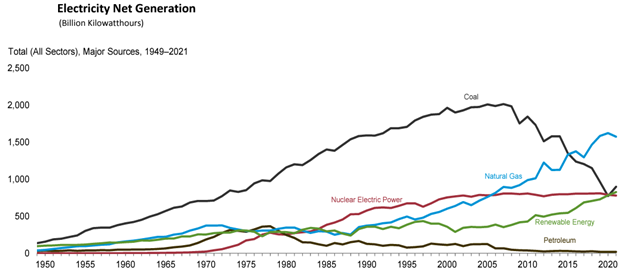

Energy production by source over the past 70 years has seen a shift away from coal to natural gas and renewables. The line graph below, from the U.S. Energy Information Administration (EIA) monthly energy review (August 2022), undoubtedly illustrates that shift1.

Over the past 70 years, energy production from renewables has been at a slight incline thus affecting fossil fuel prices. Additionally, with accelerated growth in the past 20 years. Energy production from nuclear electric power has leveled off and is declining gradually. In addition, energy production from fuel oil (petroleum) has been all but eliminated. With that said, the changes seen from the aforementioned sources are minor compared to those seen with the use of coal and natural gas. In the past 20 years, the total percentage of energy production from coal has been more than cut in half. Furthermore, production from natural gas has more than doubled.

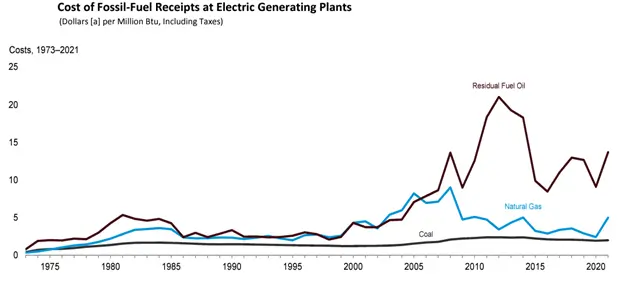

One can argue the benefits of the shift from coal to natural gas, but from a cost perspective, natural gas prices have historically been much more unstable than coal prices for power plants. Over the past 70 years, the inflation-adjusted cost of coal has remained relatively constant. A much different statement can be made for the cost of natural gas, as natural gas pricing seems to fluctuate over time. See the below line graph for an illustration of coal prices over time compared to natural gas prices over time1.

There are many factors on the supply and demand side for natural gas that cause this fluctuating price2. Many of these do not affect the price of coal:

The winter and summer weather, on the demand side of natural gas pricing, has a significant impact on the cost. This is because of the residential and commercial usage of natural gas. For example, during the winter months, residential consumers heat their homes with natural gas, driving up demand. There was a time in U.S. history when residents heated their homes with coal. However, this practice has been widely eliminated and the majority of homes in the U.S. are now heated with electric heat pumps (~37%) and gas furnaces (~48%).

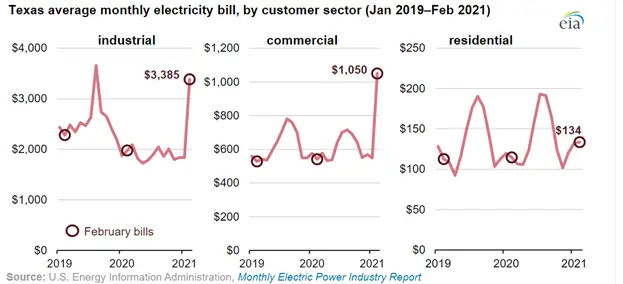

Over the past couple of years, consumers in Texas have been exposed to pricing swings, caused by the supply and demand issues surrounding natural gas discussed above. A winter storm in early 2021 drove the demand for natural gas through the roof, spiking electricity costs for consumers. If a more stable-priced fuel had been available for generation during this winter storm, many Texans might not have experienced this devastating pricing swing.

As the use of coal continues to decline and the use of natural gas as our primary fuel source to generate electricity continues to rise, electricity pricing swings will become more prevalent to consumers in the current market structure. Similar events to what happened in Texas during the winter of 2021 may become more commonplace across the country. Thus lawmakers, power producers, regulators, and distributors must take steps to stabilize fuel costs for generation and in turn, retail electric costs for consumers.

1 – U.S. Energy Information Administration / Monthly Energy Review August 2022. Data, 1949-2021. Retrieved from https://www.eia.gov/totalenergy/data/monthly/pdf/mer.pdf

2 – Natural Gas Explained. Factors affecting natural gas prices. U.S. Energy Information Administration. Retrieved from https://www.eia.gov/energyexplained/natural-gas/factors-affecting-natural-gas-prices.php